Loan approval is one of the most crucial processes for banks and financial institutions. However, traditional techniques tend to process slowly and review manually with risks of errors. Agentic AI can mitigate these risks via automation, which accelerates and promotes accuracy in the loan approval process. It helps banks streamline operations of the loan process, which minimizes human efforts and eases decision-making. Do you want to know the role of Agentic AI in automated loan approval? This blog discusses what automated loan approval is and the benefits of implementing a smart and automated loan approval process.

What is Automated Loan Approval?

Automated loan approval is a process that uses advanced algorithms and ML models to assess loan applications with credit worth and make independent approval decisions. Manual process automation and reducing the risks of human errors speed up the loan approval procedure from application to the final step. Such an approach uses massive datasets and advanced analytical models to evaluate factors, such as income levels, credit scores, and real-time payment records, which speeds up the decision-making process.

Agentic AI is an innovative technology, which implements smart agents to independently manage different phases of the loan approval process. It is the technology that ensures smooth operations, diminishes errors, improves the overall quality of decisions, and results in more effective and trusted loan processing.

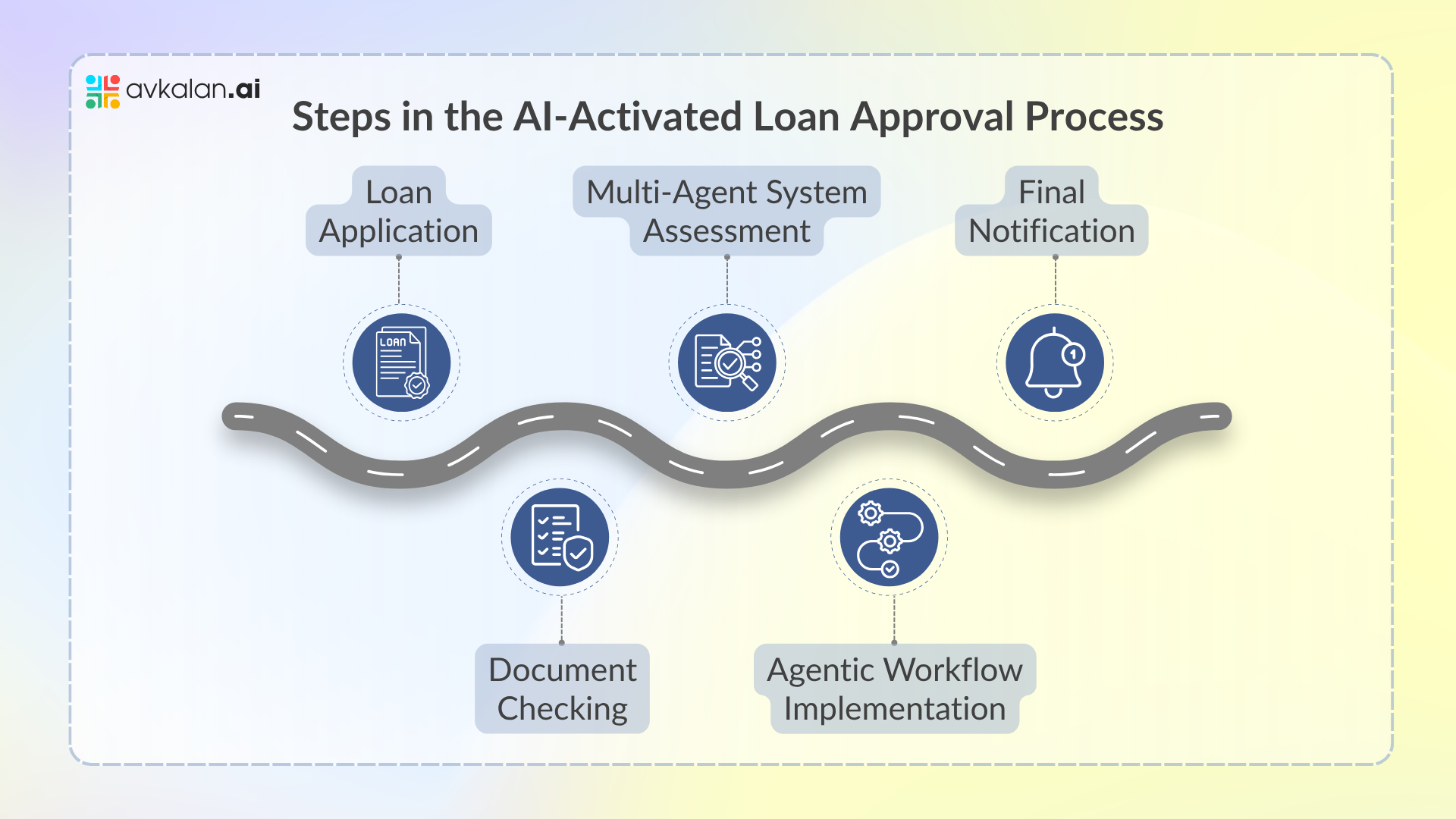

Steps in the AI-Activated Loan Approval Process

Here are the steps involved in the AI-centric loan approval process:

- Loan Application : The lending process initiates with a loan application with the required documents. It is the initial step of Agentic AI implementation that speeds up the loan approval process. This AI system collects all user information and arranges them properly for more analysis.

- Document Checking : Once the required documents are uploaded, the AI system reads them via OCR to extract important details. It minimizes the chances of human errors and captures information properly for a detailed analysis. The OCR integration availability in the system collects the available information, mostly identification documents and income statements.

- Multi-Agent System Assessment : After document verification, the internal information is put into a multi-agent system. Many similar AI agents are specialized in tasks such as fraud assessment, credit analysis, and risk evaluation. The collaborative nature makes the AI system workable to assess all the loan application aspects via multiple datasets and factors. Agentic AI ensures that evaluations are accurate and depends on massive amounts of data to make the right decisions.

- Agentic Workflow Implementation : Agentic workflows have structured the processing of loan applications with all the apps following the relevant strategies. Such a workflow helps in activities like form completion, which would be necessary in the process. It ensures all the documents are complete and comply with the regulations. As a consequence, it significantly saves processing time, boosts operational efficiencies, and delivers a smoother UX.

- Final Notification : As the system gets appraised, an officer checks the loan application. It is a crucial quality control measure as one gets confirmed if they will fulfill the requirements. After the application is approved, the AI system notifies users of the status. The quick communication satisfies customers as the loan application process’s feed and conclusion are received quickly.

5 Ways Agentic AI Helps in Automated Loan Approval

Here are the ways how Agentic AI improves the automated loan approval process:

- Coordinate the Specialized Agent Activities : The master agent monitors the full loan approval process by coordinating the activities of specialized agents. It combines their outcomes to deliver a detailed assessment and check if all the steps are performed effectively.

- Take Human Feedback : Agentic AI simplifies communication between human experts and automated systems. It gathers user feedback and collects important insights, which helps the system to adjust and upgrade depending on the real-time experiences.

- Analyze Risks and Credit Scores : Evaluate the financial risks related to a loan application. AgenticAI evaluates credit scores, payment, and income records. It implements advanced analytics to evaluate creditworthiness and predict the chances of payment.

- Assess Fraud : The fraud evaluator checks compliance applications and identifies peculiar activities. It ensures all loan requests follow the legal rules and actively searches for possible fraudulent acts.

- Automate Reporting Agent : Agentic AI generates precise reports on loan applications and their consequences. It combines data from the full process, which delivers insights to stakeholders and maintains transparency in the approval operations.

Benefits of Automated Loan Approval Operations

Here are the key benefits of the automated loan approval process:

- Decreased Underwriting Duration : The underwriting duration noticeably reduces in the composite AI framework, which reduces the loan application processing duration for lenders. Such quick turnaround adds convenience to borrowers by decreasing waiting periods and improving customer satisfaction. Plus, efficient operations improve workflow for banks and financial institutions.

- Minimize Errors in Decision Making : Manual efforts tend to include many errors and biases. Agentic AI implementation improves accuracy in decision and lending depending on real data and analysis. Thus, lenders are ensured to lend to the deserved clients.

- Detect Fraud : Advanced algorithms easily detect fraud as the lender can identify suspicious acts. Anomaly assessment and real-time patterns by the AI system identify any possible fraud before it occurs, which gives relief to financial institutions and their customers.

- Easily Scale Operations : Agentic AI framework is built to scale smoothly because of the upward trends in loan applications, which ensure performances are consistent. Financial institutions may accommodate the surging demand without new resources and adjusting the current infrastructure.

- Add Flexibility to Compliance Approach : Market compliance and real-time regulations keep changing. The AI system can consistently track the new compliance requirements. Thus, lenders can ignore legal risks and maintain operational efficiencies. The flexible compliance strategy keeps a financial institution updated in the ever-changing controlling environment.

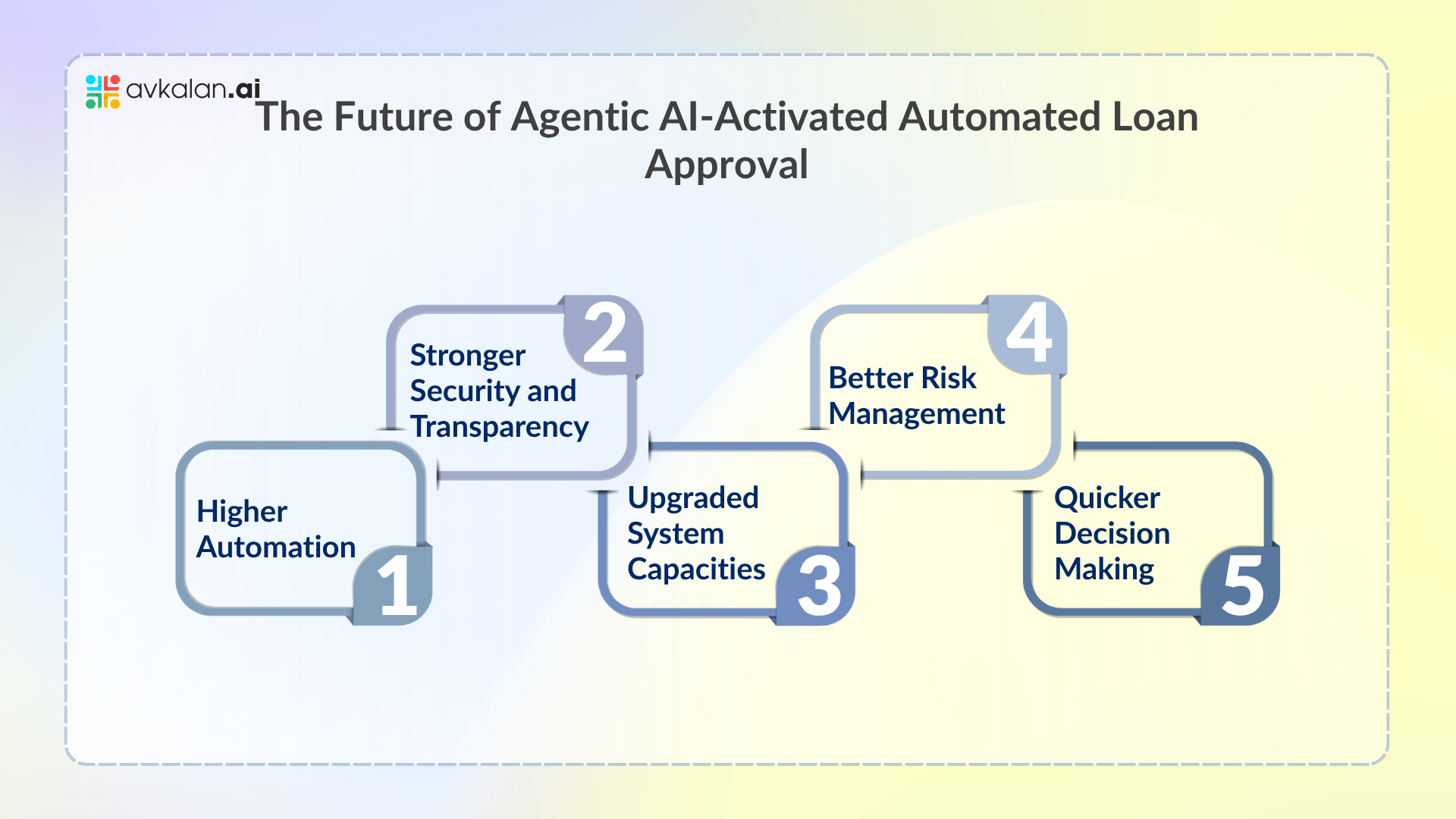

The Future of Agentic AI-Activated Automated Loan Approval

Here are the highlights of the Agentic AI-activated Automated Loan approval future:

- Higher Automation : Since Agentic workflows keep evolving, the dependency on human efforts in the loan approval process is likely to decrease, which will streamline operations effectively.

- Stronger Security and Transparency : The integration of blockchain with cutting-edge technologies will boost loan transactions’ security and transparency, which creates a more trusted lending setup.

- Upgraded System Capacities : Financial institutions are likely to advance their loan approval systems via consistent investment in cutting-edge technologies, which improves processing.

- Better Risk Management : Predictive analytics will help lenders quickly detect possible risks and enable them to modify their strategies depending on predicted marketplace trends and buyer behaviors.

- Quicker Decision Making : The upcoming technologies will quicken the loan decisions. The lenders will timely respond to apps and boost overall operations.

Utility Cases for Automated Loan Approval in Financial Institutions

Here are the most common use cases for automated loan approval:

- Personal Loan Instant Approval : Real-time income and credit score analysis help in instant loan approval. The waiting has significantly reduced, which satisfies more customers.

- SME Loan Sanctions : Quick appraisals of the financial records of SMEs afford loan approvals. It helps businesses to make the most of growth opportunities without delays.

- Mortgage Underwriting : It eases the mortgage approval procedure with quick credit score assessment and property price appraisal. As a consequence, the decision-making and closings speed up significantly.

- Better Fraud Detection : The patterns of loan application are what identify fraud activities. Such a strategy helps the lender to be protected against probable losses and strengthens the approval integrity.

- Predictive Analysis : When it comes to mitigating fraud risk with financial and historical data, defaulting risks are predictable. The qualified borrowers get targeted on the reduced non-performing loans.

- Automated Compliance Review : The loan approval process involves monitoring regulatory compliance, which minimizes risks. Such automation speeds up the loan approval process and ensures following the legal rules.

Agentic AI Automates Loan Approval

The automation of loan approval by Agentic AI can change the game in the finance industry. AI-activated systems offer massive benefits to both borrowers and lenders by removing manual processes, which increases accuracy. With the evolution of the finance industry, using technologies such as RPA, NLP, and ML, will be crucial for financial institutions to get the edge. The best AI consulting services provider can always suggest to you how to effectively implement Agentic AI. The loan approval process seems to be autonomous and customer-centric with Agentic AI implementation that is likely to build a more dynamic lending setup.