I. Introduction

In the dynamic world of finance, Artificial Intelligence (AI) is not just a tool but a game-changer, especially in the realm of fraud detection. In the simplest terms, AI refers to the capability of machines to mimic human intelligence processes by learning from data, to reason and solve, thus making intelligent decisions. When AI is applied to fraud detection, it essentially means using these intelligent systems to identify and prevent fraudulent activities.

A. How AI Has Historically Been Used in Fraud Detection

Before the introduction of Large Language Models (LLMs), AI in fraud detection relied on a variety of methods and technologies, each with its unique strengths and capabilities. These methods were instrumental in advancing the field of fraud detection to where it stands today. Here’s an overview of some key approaches:

- Rule-Based Systems:

One of the earliest forms of AI in fraud detection is the rule-based systems, these systems operate on predefined rules set by experts. If a transaction or behavior matched these rules (e.g., a very high-value transaction or rapid frequency of transactions), it was flagged as suspicious. While effective for known fraud patterns, these systems became less adaptable to evolving fraudulent schemes and in cases, when the fraudsters knew the rules.

- Data Mining and Pattern Recognition:

In contrast to rule-based systems that rely solely on predefined rules, data mining involves algorithms that sift through large datasets to uncover hidden patterns, correlations, and anomalies that were not obvious to human analysts. By identifying such patterns, activities that deviate from typical behavior were flagged as potentially fraudulent.

These earlier methods, while sometimes limited in their adaptability to new and complex fraud schemes, laid the groundwork for the continuous evolution of AI in this critical field. A few examples of fraud detection tools include DataVisor which provides transaction fraud monitoring and decisioning solutions for banks, fintechs, and digital payments based on AI and ML. LexisNexis is another such data analytics provider, allowing businesses to gain insights for effective risk management.

II. Case Studies and Real-world Examples Demonstrating the Benefits of These Models

Let’s look at some success stories of companies employing AI for fraud detection to mitigate scams and fraudulent transactions.

PayPal

In its initial stages, PayPal faced severe fraud-related challenges, with fraud rates soaring and substantial financial losses. This not only threatened the company’s profitability but also its relationships with credit card associations and overall business viability. However, PayPal’s acquisition of Simility in 2018 significantly bolstered its AI capabilities. Simility specializes in using machine learning for login, signup, and payment frauds, combining unsupervised and supervised learning models. This integration of Simility with Paypal required a blend of in-house expertise and new talent brought in through acquisitions. This transformation established PayPal as a leader in the field of AI-powered fraud detection. The company’s efforts not only significantly reduced fraud rates but also improved customer trust and the overall user experience.

MasterCard

Mastercard has been proactively leveraging AI to enhance its fraud detection capabilities and improve the e-payment experience for consumers and businesses. One of Mastercard’s notable AI implementations is the Consumer Fraud Risk tool. This innovative solution analyzes accounts’ histories and their connections with other accounts involved in scams or money-laundering activities to halt payments to fraudsters in real-time. In the U.K., where this tool has been deployed, one of the banks reported a substantial drop in scam payments by 20% within four months of use. The introduction of AI and ML by Mastercard has led to 3x reduction in fraudulent transactions and 10x reduction in false positives, globally.

CitiBank

Citibank, the first national bank of New York has been actively incorporating AI in its operations, particularly for fraud detection. One of their significant initiatives is the partnership with Feedzai, an AI platform specializing in risk management and fraud detection in banking. Citibank’s deployment of AI in their payment systems, such as the Citi® Payment Outlier Detection, has been implemented in over 90 countries. This solution uses advanced analytics, AI, and ML to identify outlier payments, which are payments that do not conform to clients’ past patterns of payment activity. It allows clients to review and approve or reject such outlier payments, offering enhanced control and monitoring of payments and reducing risks associated with outlier payments.

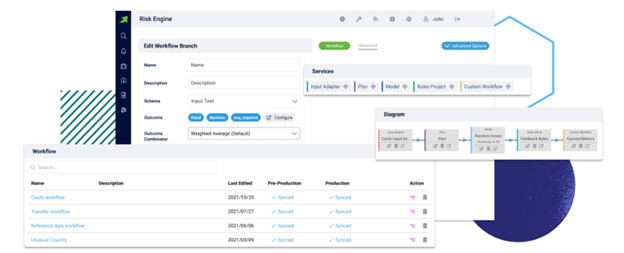

The basic workflow of Feedzai is demonstrated below, the incorporation of which reduced the incidence of false positives and improved operational efficiency for Citibank transactions.

III. Application of LLMs in Fraud Detection

With the introduction of LLMs, the landscape of AI in fraud detection witnessed a significant transformation. Essentially, LLMs are trained on massive datasets of text, enabling them to sift through and make sense of vast amounts of unstructured data, such as emails or social media posts, providing a deeper and more nuanced understanding of potential fraudulent activities.

A. Overview of the Use of AI and LLMs in Fraud Detection (Highlighting the Difference in Impact Between LLMs and Previous Measures)

Traditional fraud detection methods, including rule-based systems and pattern recognition, have certain limitations that can hamper their effectiveness in the constantly evolving landscape of financial fraud. The major limitations are discussed below:

- High False Positive Rates:

A significant drawback of rule-based approaches is their tendency to generate a high number of false positives. This can overwhelm investigators with irrelevant alerts. LLMs reduce false positives by understanding data patterns and context, providing a more accurate differentiation between legitimate activities and actual fraud.

- Static and Inflexibility:

LLMs, with their advanced learning capabilities, continuously evolve by analyzing new data, allowing them to adapt quickly to emerging fraud patterns and outpace the tactics of fraudsters as opposed to static, rule-based systems.

- Handling Complex Data:

LLMs excel in processing and making sense of complex, high-dimensional data, enabling them to uncover subtle fraud patterns that traditional methods might miss.

- Scalability Challenges:

With the ever-increasing volume of transactions in modern financial systems, these traditional methods struggle. Thanks to their sophisticated algorithms, LLMs can efficiently process and analyze large volumes of data in real time.

- Limited Contextual Understanding:

Rule-based methods cannot often comprehend the broader context of transactions. This limitation can lead to misinterpretations and unwarranted alerts. LLMs possess a deep contextual understanding, allowing them to analyze the broader context of transactions and behaviors.

B. Discussing Specific Fraud Detection Techniques and Methodologies Powered by AI

Let’s dive into an overview of the methodology for fraud detection using LLMs like GPT-4 to get a general understanding of how fraud detection techniques work.

1. Data Collection and Preprocessing:

The first step to an accurate system for fraud detection is having textual data relevant to the context, such as emails, transaction descriptions, and financial documents.

Next, clean and preprocess the data to remove irrelevant information, normalize text (like converting all text to lowercase, removing special characters), and segment into manageable chunks.

2. Feature Extraction and Analysis:

Extract and analyze specific keywords, phrases, or patterns of speech that are commonly associated with fraudulent activities.

3. Model Training for Pattern Recognition:

If labeled data is available, train the LLM on examples of known fraudulent and non-fraudulent communications to learn distinguishing features using SVM, Random Forest or Naive Bayes Classifier. In the absence of labeled data, use unsupervised techniques to let the LLM identify potentially fraudulent patterns on its own using K-Means Clustering or Gaussian Mixture Models (GMMs). Validate the model’s results on test data using performance metrics such as F1-score, and AUC-ROC.

4. Deployment, Adaptation, and Evolution:

Integrate this model into real-time systems to analyze ongoing communications and transactions, providing immediate flags and alerts for potential fraud. Regularly update the model to adapt to new types of fraud. Fraudsters continuously evolve their methods, and the LLM needs to be trained on the latest data and trends.

IV. Integrating Privacy-Preserving LLMs into Fraud Detection

The incorporation of privacy-focused LLMs in fraud detection marks a critical step towards leveraging AI’s power responsibly, ensuring that the benefits of advanced fraud detection are not achieved at the expense of individual privacy rights.

A. Exploring the Incorporation of Privacy-Focused LLMs in Fraud Detection Systems

The key characteristics of privacy-focused LLMs include:

- Data Anonymization and Pseudonymization:

Before processing data, personal identifiers are removed or replaced with pseudonyms. This ensures that the LLM analyzes patterns without exposing individual identities.

- Differential Privacy:

To maintain overall privacy and statistical integrity, the LLM is trained on data that has a layer of noise added to it in a way that prevents the model from revealing sensitive information about individuals in the dataset.

- Federated Learning:

This allows LLMs to be trained across multiple decentralized devices or servers holding local data samples, without exchanging them, allowing detection without compromising the privacy of the data source.

- Encrypted Data Analysis:

Using techniques like homomorphic encryption, the LLM can analyze encrypted data without ever decrypting it, ensuring that sensitive information remains secure.

LLMs like GPT-4 can be instrumental in fraud detection from analyzing emails for scams to verifying the authenticity of documents and analyzing voice conversations to identify stress in caller’s voice. This level of analysis marks a significant leap forward in the domain of fraud detection and security.

V. Conclusion

In conclusion, the evolution of AI in fraud detection, especially with the introduction of LLMs, represents a transformative shift in the field. These advanced models provide a more accurate, adaptable, and scalable approach to detecting and preventing fraud, all while upholding the highest standards of data privacy. As we continue to witness the rapid advancement of AI technologies and their utilization by major organizations, it’s clear that AI will play a pivotal role in shaping the future of fraud detection, offering a harmonious balance between innovative fraud prevention and stringent privacy protection.