Introduction

In the fast-paced financial world, the significance of robust credit management and risk scoring can’t be overstated. It’s all about keeping the cash flowing and avoiding bad debt, crucial for any business’s survival and growth. Providing financial stability to the business which in turn helps the business to flourish by ensuring timely payments of customers and even increasing the profits of the business

Naturally, no business would give their trust and use a credit score system with every client. Therefore, Credit Management and Credit risk scoring go hand in hand as risk assessment is a vital component for the success of the system. Certain measures, such as assessing the client’s trustworthiness and their ability to repay debt, are in place.

As we delve deeper, we’ll explore how the traditional playbook is getting a high-tech makeover, courtesy of advancements in AI and Machine Learning (ML).

AI and ML: Transforming Credit Risk Assessment

The use of AI and ML in a business should become a no-brainer by now as most businesses face these hurdles in credit management limited data scope, potential biases, and static risk assessments. The question becomes how will your business benefit from AI and ML and how will it solve these issues?

![]() Limitless Data Scope

Limitless Data Scope

Staff in a company rely only on traditional data sources, like credit history and income, which may not fully capture a borrower’s creditworthiness. Whereas AI and ML can analyze various aspects of a client’s history, including behaviors, social media activity, and other details that a financial assessor might overlook. This comprehensive analysis allows AI to process large amounts of data, identify patterns, and optimize credit risk management with minimal errors.

Reduced Default Rates

A part where most credit management systems usually lack is having low default rates therefore our question becomes how can we use AI-driven models to reduce default rates?

- Enhancing loan monitoring

- Predicting borrower repayment behaviors

- Identifying potential default risks.

- AI monitors borrowers’ spending and payment patterns to detect unfavorable behaviors such as delayed payments or consistent

Utilizing both real-time and historical data, including bank statements, credit reports, and transaction histories, AI algorithms such as obviously.ai assess the likelihood of borrower defaults by analyzing past loan patterns of the client. Additionally, AI improves lender-borrower communication by offering a more transparent plan that is personalized and suitable for each borrower. AI aids in reducing default rates, thereby optimizing recovery and resolution efforts in credit management.

Improved Decision Making

Biases, an inevitable human trait that follows us in every industry but even more in business-related subjects become a huge problem that can lead to the loss of valuable clients to drastically less valuable ones.

By relying on more data-driven decisions rather than personal opinions a business can ensure decisions are based on quantifiable information rather than subjective judgment. Improving objectivity and fairness is a must for a business’s success, not only that but AI can identify already existing biases and render all the disproportionality in the current system.

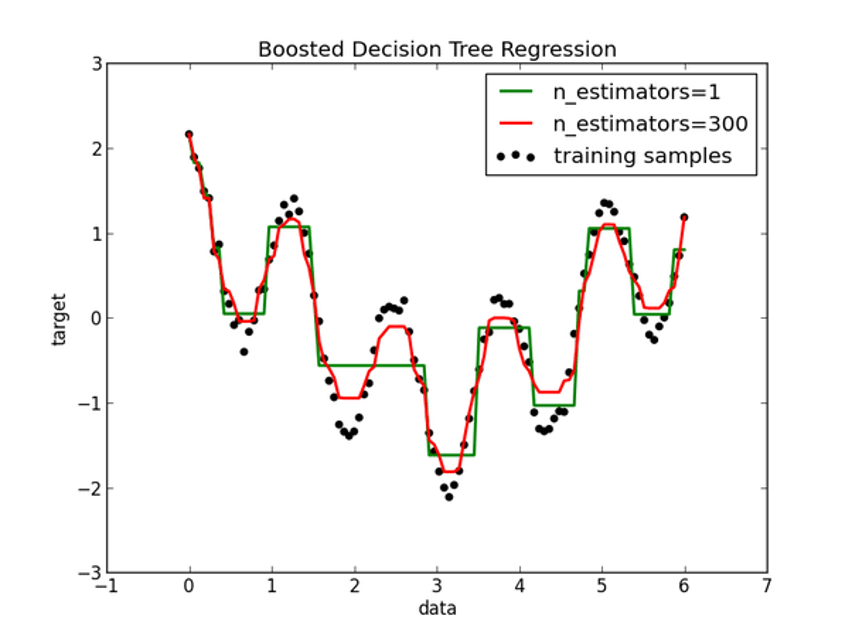

Past, Present & Future Risk Assessments

AI’s adaptability and machine learning incorporation give us a system that continuously teaches itself and improves in contrast to manual labor. The biggest trap companies fall into while performing a risk assessment is not having a predictive model of the customer’s trajectory. That’s where AI shines by reviewing all past and current finances of a customer to predict an accurate representation of the customer’s future creditworthiness.

Case Studies: Success Stories of AI in Credit Management

Implementing a solution without seeing some successful examples would be always a mistake, looking at these exceptional results is eye-opening.

Atlas Credit

A recent case study conducted by Experian highlights the significant impact of AI machine learning models on lending practices, with Atlas Credit experiencing nearly doubled loan approval rates while reducing risk losses by up to 20%. A great example of true success by a financial company showcasing how an AI like Experian helped boost their performance immensely. This demonstrates the potential of AI to streamline manual tasks, providing greater flexibility in labor allocation and a broader understanding of data. For instance, automatic reminder notices to customers before invoice due dates and utilizing new data based on credit ratings can enhance efficiency and customer engagement.

Mosaic

Mosaic, a leading mining company listed on the Fortune 500, boasting an impressive annual revenue exceeding $12.35 billion, recently introduced an AI-driven credit risk management system. Enhancing their efficacy by reviewing the vast sea of information from documents and finally deciding the client’s creditworthiness.

As their case study showcases they took their credit management system to the next level:

- 50% Reduction of Credit Approval Layers

- 56% Reduction in Average Approval Time

- 15% Increase in Auto Approvals

- 40% Reduction in Team Size Making Savings in FTE Cost

How did they achieve such results?

The credit team utilizes auto-approvals to expedite periodic reviews for all customers. Automatic aggregation of credit data from both global and local agencies ensures seamless credit management. They tailored credit scoring models and continuous real-time credit monitoring to mitigate potential risks effectively.

ROI Impact of Implementing AI Solutions

The integration of AI solutions holds immense potential to drive exceptional returns on investment (ROI) for businesses across diverse sectors. For instance, findings from a report by McKinsey & Company indicate that AI-driven automation has the potential to boost global productivity by up to 1.4% annually. This shows us that the advantages of AI are not only for reducing risk and losses but can also gain us profit, thereby exerting a positive influence on the overall bottom line. How does it improve ROI more you might ask? The answer is that opening a vast market of opportunities as credit management of the right clients can lead to strong connections to build a business.

Provenir A Bright Example In AI Credit Management

Provenir stands out as a provider of advanced AI-driven solutions tailored specifically to the financial services sector, with a particular focus on credit risk management. Through the utilization of Provenir’s platform, financial institutions can streamline credit decision-making processes, driving operational efficiencies and increasing profitability.

Showcasing the use of Provenir, Elevate Credit used their non-linear and linear modeling techniques they have simplified their business strategy which made them much more adaptable in their field.

Flexiplan’s success story is a bright light showing the future of using AI in credit management. The company now approves up to 60 loans in the time that it used to have taken for 1 loan! Not only that, but it expects a 40% profit increase while using Provenir as a risk-decisioning platform in its credit system.

Challenges and Considerations in AI Adoption

Exploring the integration of Artificial Intelligence (AI) into credit management systems brings considerations and challenges for CEOs which they must focus on before employing it. At the heart of this exploration is the balance between significant investment costs and the necessity for budget allocation. It’s essential for leaders to not only justify these investments to stakeholders but also to highlight the benefits of AI which are not only limited to but include long-term ROI, profit, and efficiencies.

Data & Privacy: Safeguarding Financial Trust

We have to consider before integrating AI the safeguarding of data privacy and security. As these systems go through large volumes of sensitive customer data, to make sure the protection of this information becomes a must. This extends beyond just technical measures; it’s about making sure trust and regulations like GDPR and CCPA, are implemented correctly.

Decision-makers must ensure that AI implementations comply with industry regulations and standards to avoid legal issues and protect customer privacy. Losing financial or credit risk assessment data could devastate AI-driven businesses, leading to financial losses, regulatory fines, and legal battles. This goes beyond numbers, impacting customer trust, investor confidence, and operational stability. With heightened credit risk and cybersecurity concerns, proactive measures are essential to safeguard data, ensuring sustainable business growth and maintaining a competitive edge in the data-driven landscape.

We have to prioritize transparency, accountability, and responsible AI practices, so organizations can effectively integrate AI into credit management systems. This not only maximizes value and minimizes risks but also positions these organizations as leaders in the responsible use of AI. The narrative around AI in credit management, thus, shifts from a tale of challenges to one of strategic innovation and ethical leadership, offering a blueprint for success in the digital age.

Conclusion

In conclusion, the incorporation of AI and generative AI tools into credit assessment and management systems represents a transformative shift towards reducing default rates and an increase in efficacy for assessment. With the successful implementations by companies in the financial field like Atlas Credit, Mosaic, and Provenir, we witness the tangible benefits of these AI-driven solutions. However, the journey towards integrating AI demands a careful balance between technological advancement and the imperatives of data privacy, security, and ethical considerations.

Embracing AI with a focus on transparency, accountability, and responsible practices paves the way for not only maximizing benefits and minimizing risks but also for fostering trust and setting new benchmarks for innovation and ethical leadership in the finance industry. This shift towards AI-enhanced credit management is not merely a strategy for risk mitigation but a gateway to unlocking new possibilities for growth and inclusivity in the financial landscape.