AI is evolving rapidly with Agentic AI making a significant impact in multiple industries. Even after the emergence of AI technologies, fraud activities haven’t decreased since fraudsters are using innovative tricks to exploit susceptibilities. Businesses implementing advanced AI solutions are failing to protect themselves from fraudsters. GenAI, which simplifies data analysis and helps in compliance, isn’t sufficient for big enterprises to protect themselves from fraudsters. That is when AgenticAI comes to your rescue since it boosts adaptability and proactive fraud prevention. Are you wondering if it can help to prevent fraud in financial institutions? Here you will learn the same. But before that, let’s discuss the differences between RegTech, GenAI, and AgenticAI. Keep reading.

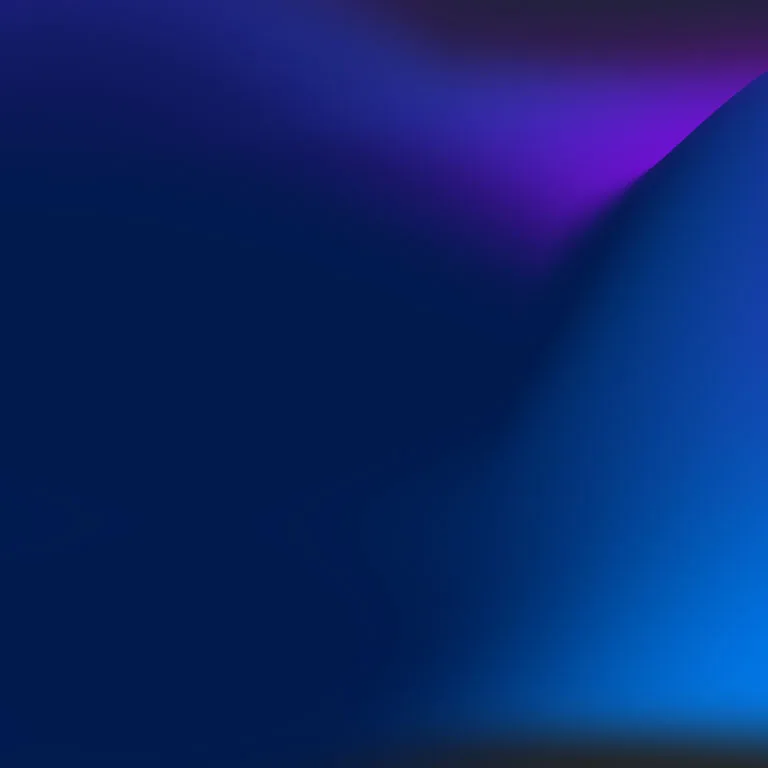

Differences Between RegTech, GenAI, and Agentic AI

You should know the differences between AI terms, such as RegTech, GenAI, and Agentic AI, to make the right choice for your financial institution.

- RegTech : It focuses on regulatory reporting and compliance and automates fraud detection and risk management strategies. Plus, it follows preset rules and lacks the adaptability to possible threats.

- GenAI : It simplifies data analysis, delivers reports, and helps in customer interactions. Even though it is robust, it can’t take effective actions against fraud.

- Agentic AI : It is the most advanced layer that consistently learns, adapts, and makes real-time decisions to prevent fraud before its occurrence.

While RegTech AI and GenAI mainly focus on compliance and analysis, Agentic AI functions like a central brain, which arranges, plans, and performs tasks independently at scale to stop real-time fraud. It constantly adjusts to innovative fraud techniques, learns from patterns, and advances threats to take quick actions against fraud activities. Agentic AI is mainly beneficial for financial institutions that require an active fraud prevention system, which can respond dynamically to possible threats. The Agentic AI effectiveness increases with seamless integration with the current AI-activated systems to ensure an all-inclusive approach to prevent fraud. A combination of these three AI models can work as a fraud prevention strategy for financial institutions. Agentic AI may function as the core that coordinates all activities across all AI levels.

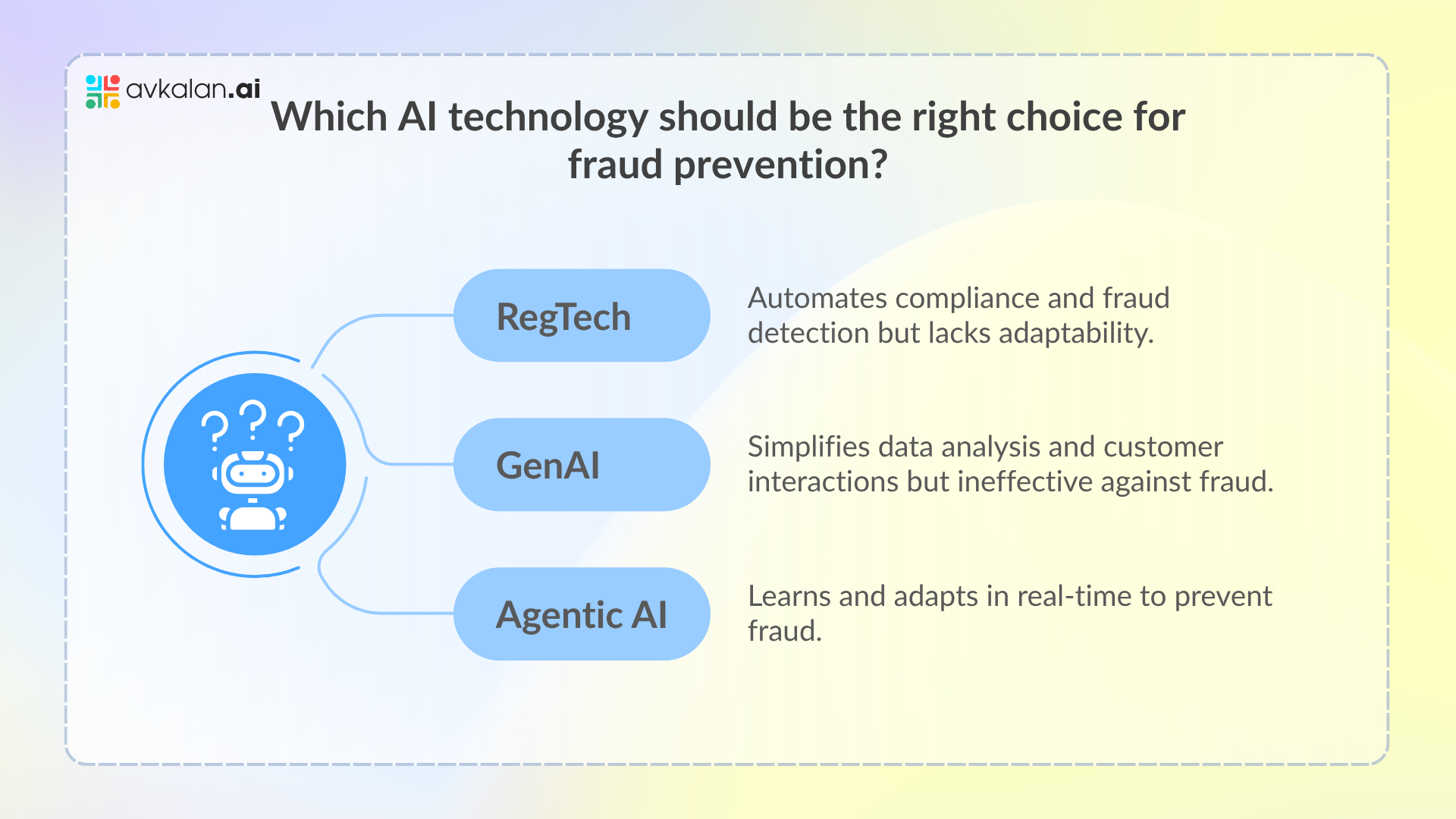

Why Does Agentic AI Implementation Work for Fraud Prevention?

Agentic AI works like an extremely smart fraud prevention command point, which can process huge amounts of data, identify threats, and take immediate countertops. Here are the key reasons why implementing Agentic AI can help in preventing fraud:

- Prediction : Fraud prevention is not only about predicting but reacting. Agentic AI predicts fraud patterns and adjusts fraud risk evaluations in real time.

- Reasoning : Agentic AI interprets the intentions behind suspicious acts rather than only flagging abnormalities. It can make context-aware decisions to separate between fraudulent and legitimate behaviors.

- Execution : Agentic AI takes action instantly by blocking fraud transactions, requesting extra verifications, and elevating high-risk cases.

- External Memory : Agentic AI recollects previous fraud patterns and keeps learning, improving accuracy in identifying the latest fraud strategies, which may surpass normal security measures.

Agentic AI is not fully independent even after working totally by itself. It autonomously performs 80 to 90% of the routine activities, while the rest, 10 to 20%, require human intervention, which is crucial for monitoring and consistent learning. Each human decision upgrades Agentic AI, which increases its effectiveness and adaptability over time.

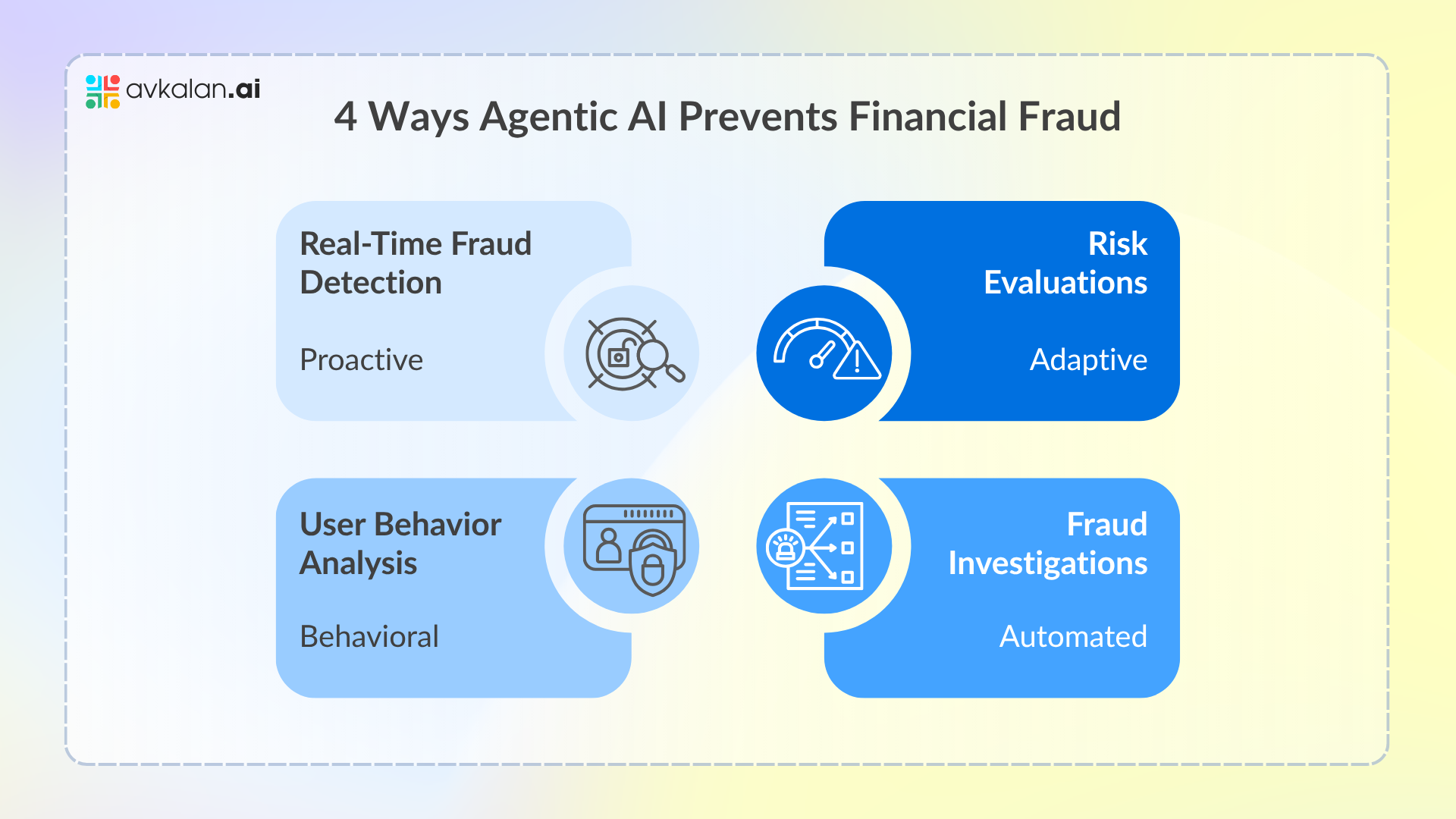

4 Ways Agentic AI Prevents Financial Fraud

Here are the ways Agentic AI can help in fraud prevention:

- Real-Time Fraud Detection and Prevention : Since fraudsters move quickly, your financial institution should move much quicker. Traditional fraud detection depends on preset rules and past data, which means it tends to react to fraud rather than mitigate it. Agentic AI levels up the game by taking real-time actions, consistently monitoring transactions, assessing huge amounts of financial data, and immediately identifying suspicious activities before any losses occur.Such a proactive approach is important in today’s digital world. Agentic AI’s capabilities of independently detecting and blocking real-time fraud transactions secure financial institutions. Banks can immediately prevent fraud before its occurrence, which protects customers and reduces the chances of big financial losses.

- Consistent Learning on User Behavior with Agentic AI-Activated Behavioral Analysis : Agentic AI targets user behavior and evaluates how they interact with real-time financial environments rather than depending on static credentials and previous fraud markers. All users have a distinguishing digital footprint, which includes typing speed, mouse movements, preferred devices, navigation, and transaction patterns. Agentic AI keeps learning from such behavioral patterns and detects even the most minor peculiarities, which reflect fraudulent activities.For instance, a fraudster can enter account details with various keystroke dynamics with stolen credentials, navigate a portal, and make unfamiliar transactions. Agentic AI may flag suspicious activities depending on inconsistent behaviour even if the credentials seem to be illegal. Such a method matters as an increasing number of fraudsters depend on AI-driven scams and automated bots to imitate real user behavior. Agentic AI analyzes fraud before it occurs by consistently implementing new fraud strategies, which reduces false positives and boosts security for authentic users.

- Dynamic Risk Evaluations and Adaptive Fraud Scoring : Since fraud is consistently evolving, risk evaluations depending on static rules don’t work anymore. Financial institutions require a fraud prevention system that adjusts to the changing real-time environment to deal with innovative fraud strategies.Agentic AI implements adaptive fraud scoring that consistently upgrades risk levels depending on user behavior, real-time data, and new fraud techniques. Agentic AI understands all interactions, which makes it more difficult for fraudsters to exploit the security modes. Such a dynamic approach is challenging since many companies experienced a rise in fraud attempts on customer accounts. Agentic AI assists financial institutions stay ahead of criminals preventing losses before their occurrence by consistently adjusting the levels of fraud risks.

- Case Prioritization and Automated Fraud Investigations : Since fraud investigations are time-consuming, your teams are required to manually evaluate transaction records, collect evidence, and prioritize cases. Such a delayed response gives fraudsters an edge, which helps them to pass the stolen money before they get flagged.Agentic AI can always automate and speed up the fraud investigation process by evaluating big datasets in seconds and ranking cases depending on risk levels and their severity. Financial institutions can prioritize the most emergency fraud cases, which noticeably reduces investigation times from days to minutes. It prevents severe losses and gives quicker justice to fraudsters.

Agentic AI – Smarter and Stronger Solution for Future Fraud Prevention

| AI Type | Focus | Adaptability | Actionability |

|---|---|---|---|

| RegTech | Compliance | Low (rule-based) | Automated reports |

| GenAI | Data analysis | Moderate | Insights generation |

| Agentic AI | Real-time prevention | High (self-learning) | Direct fraud blocking |

Now you know how Agentic AI can help in fraud prevention. The Agentic AI implementation in fraud prevention strategies protects financial institutions against the changing world of financial crime. By AI consulting, you can learn how to use Agentic AI effectively to prevent fraud. With real-time analysis and independent decision-making, this technology helps in fraud detection and limits the opportunities for fraudsters, which protects their financial assets.